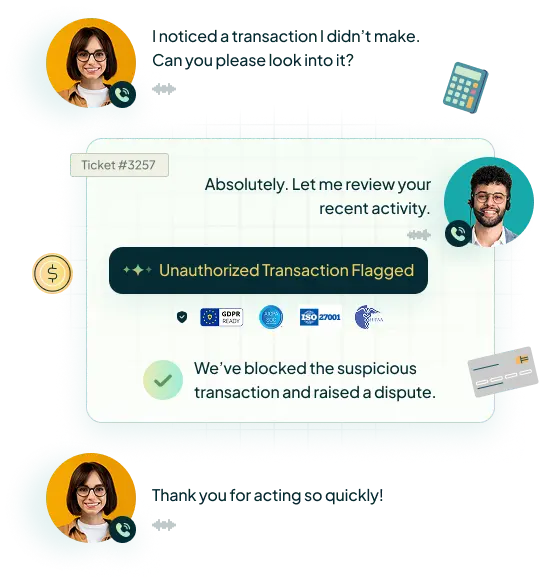

Turn Every Agent into a Trusted Advisor

No more scrambling for answers. Our Agentic AI listens, guides, and automates workflows - whether it’s resolving a fraud dispute or navigating a loan process - so your agents deliver accurate, compliant resolutions in record time.

Word Document)

Word Document) Excel File)

Excel File)